Most oil and gas company’s business structures are segmented and organized according to business segment, assets, or function.

The upstream oil and gas segment is also known as the exploration and production (E&P) sector because it encompasses activities related to searching for, recovering and producing crude oil and natural gas.

Learn more with our online oil and gas courses:

Upstream Oil and Gas - Exploration, Drilling, Production

The upstream segment is all about wells: where to locate them; how deep and how far to drill them; and how to design, construct, operate and manage them to deliver the greatest possible return on investment with the lightest, safest and smallest operational footprint.

Exploration

The exploration sector involves obtaining a lease and permission to drill from the owners of onshore or offshore acreage thought to contain oil or gas, and conducting necessary geological and geophysical (G&G) surveys required to explore for (and hopefully find) economic accumulations of oil or gas.

Drilling

There is always uncertainty in the geological and geophysical survey results. The only way to be sure that a prospect is favorable is to drill an exploratory well. Drilling wells is physically creating the “borehole” in the ground that will eventually become an oil or gas well. This work is done by rig contractors and service companies in the Oilfield Services business sector.

Production

The production sector of the upstream segment maximizes recovery of petroleum from subsurface reservoirs. Production activities include:

- Efficiently recovering the oil and gas in a producing filed using,

- Primary and secondary recovery methods,

- Tertiary, or enhanced oil recovery (EOR), also referred to as improved oil recovery (IOR), and

- Plug and abandonment, which marks the end of the productive life of a well. That event can occur anywhere from a few years after the well is drilled to five or six decades later.

Whether it’s oil and gas, power, or renewables that is your chosen career path, our e-learning courses can help you get a leg up on the competition and get your food in the door.

We often hear from learners who successfully use our courses to prepare for the interview process. After all, you’re using the same courses that companies themselves use to prepare their teams.

As this student passed on:

I would like to thank you for your brilliant Oil 101 materials. I did use it to prepare for the recruitment process, and managed to take a new role in the oil and gas industry!

Get started with our Energy 101 courses today!

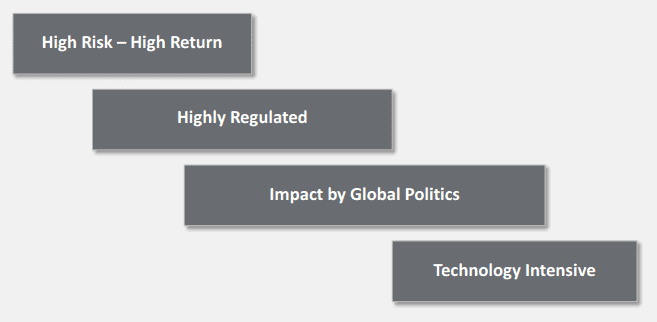

Upstream Business Characteristics

The upstream industry is arguably the most complex of all the oil and gas business sectors. As illustrated in the diagram, it is highly capital-intensive, highly risky, and highly regulated. Upstream investments are high-risk, given that results of every well drilled are unpredictable. Additional risk arises from safety and environmental issues.

Outside the US, the upstream industry is also impacted by the prevailing host country political environment and regulations, including:

- Political instability (war, civil unrest, or other international conflicts)

- Laws and regulations (environmental, social programs)

- Price controls and tax regimes

- Expropriation or forced divestiture of property

- Respect for contracts.

Upstream is also subject to global forces of supply and demand, economic growth and recessions, and crude production quotas.

Additionally, seasonal weather patterns and disruption due to severe weather events when working in exposed locations can affect production.

Technology drives all aspects of the upstream industry, adding to its capital-intensive nature.

Independents

The oil companies that focus solely on Exploration and Production are called Independents. Many of them have in the recent past set a strategy to focus primarily on natural gas prospects – not oil.

Large global independents are often publicly traded on their home country stock exchange and include such companies as EnCana, Woodside and others in the list. The largest US publicly traded independent E&P companies include Anadarko, Apache and Devon.

Independents are known for their ability to make decisions and move quicker than other industry participants described below. They are also considered early adopters of the more innovative drilling and production technologies.

Majors – IOCs

Major Oil Companies (also called Integrated Oil Companies - IOCs) also have assets in the downstream -- the refineries and service stations that bring the products to the end-user customers.

These companies have the prominent and advertised brands that you are familiar with.

NOCs

National Oil Companies (NOCs) are those industry participants that are owned and managed by governments around the world. Most of the remaining oil & gas reserves in the world are owned by NOCs - making it a challenge for Majors and Independents to sustain their operations and grow.

Oilfield Services

The Oilfield Services sector of the Upstream segment consists of companies that build the infrastructure and provide the specialized equipment, services and skills needed for exploring, drilling, testing, producing, maintaining and reclaiming crude oil and natural gas wells.

Oilfield Services is a multi-billion dollar global industry. Numerous companies in this sector are among the world’s largest. Others are smaller, regional, or independent businesses that have also developed cutting-edge technologies.

As mentioned in the History of Oil module, Mitchell Energy, founded by George Mitchell, was an aggressive E&P company that pioneered new techniques in horizontal drilling and hydraulic fracturing.

The perfection of these new drilling methods in the 1990s enabled the boom in US shale oil and gas production boom currently underway. Mitchell Energy was eventually acquired by Devon Energy, another large independent.

Oilfield services and supply companies do not typically produce oil and gas or own the assets that contain them.

However, the oil and gas companies could not develop or operate fields profitably without the Oilfield Service companies’ contributions.

At a typical drilling well site, there could be 25-30 different oilfield service companies handling the mechanical, technical and analytic operations needed to successfully complete a well.

Oilfield Service Business Characteristics

As the chart indicates, several factors characterize the Oilfield Services sector.

It is intensely competitive with numerous global participants, and the negotiating power is squarely in the hands of the oil and gas companies who control the budgets for well services and field equipment.

Other characteristics of this segment include:

- It is highly cyclical and affected by outside forces such as commodity price fluctuations and shifts in political sentiment.

- It is technology-, capital-, and labor-intensive.

- Companies find it increasingly difficult to attract skilled workers – as represented by the wage inflation experienced new shale producing areas of West Texas and North Dakota.

- The work is difficult and often dangerous, with stringent safety regulations

The US Philadelphia Stock Exchange Oil Service Sector index (symbol: OSX) tracks public companies in this sector.

The Oilfield Services industry provides the following support to Majors, Independents, and National Oil Companies (NOC’s):

Exploration services involve use of seismic methods to evaluate where and how to prove a drilling prospect, high-speed computers and advanced, 3D, visual interpretation theaters.

Drilling services include well design, drilling rig operation and process, and related technologies. Other services include formation evaluation, logging, and measurement while drilling (MWD).

Well completion involves bringing the production on line with advanced downhole equipment applications, downhole monitoring and automated well control equipment.

Production services involve application of various physical and chemical processes to increase the amount of oil or gas that can be extracted from a field, and removing contaminates to get ready for sale.

Offshore construction contractors provide design and construction of platforms, drilling rigs and sub-surface well completion equipment.

Now that you have an understanding of the major players in oil & gas and what they do, let us explain the business, technical and commercial drivers to successfully bring these commodities to customers.

Oil Reserves – Formation and Importance

The vast amounts of crude oil and natural gas trapped underground are referred to as reserves.

Proven reserves are the estimated quantities which geological and engineering data demonstrate can be recovered in future years from known reservoirs, assuming existing economic, technical and operating conditions.

Proven reserves have a more than 90 percent probability of recovery, while probable reserves have greater than 50 percent probability of recovery.

Reserve definitions can differ depending on whether an engineering estimate is used, as set by two industry bodies:

- The Society of Petroleum Engineers (SPE)

- The American Association of Petroleum Geologists (AAPG).

Engineering estimates are the summation of production forecasts based on a series of quantitative tools that use well data and production histories to estimate remaining oil or gas in place.

Other definitions related to public company reporting of reserves are set by the Securities and Exchange Commission (SEC). Rules in place since 2010 allow proven and probable reserves to be stated in annual reports.

Prior to this update, only proven reserves could be reported. This move brought the US rules in line with international standards.

Reservoir Characteristics

Oil and gas are also termed hydrocarbons because they are chemically made up of Carbon and Hydrogen atoms.

Oil and gas are not found in easy-to-access underground pools or puddles but, instead, are trapped in various rock formations and geological structures in quantities that can range from minute to massive.

Natural gas is sometimes mixed with oil but often found in separate reservoirs.

Shown on the Underground Reservoir Characteristics diagram above are four key types of geological formations needed to have oil and gas reserves in place:

- Source rock – where the oil or gas was formed

- Reservoir - where oil or gas reside, having migrated through microscopic structures in the surrounding rock

- A Seal - which is impermeable and stops the migration of the oil and gas

- A Trap – which is the combination of the reservoirs and seals

Oil and gas companies and their oilfield services providers construct wells to find the reservoirs and traps to produce the hydrocarbons to the surface. Once produced they can then be processed, transported, and refined into gasoline, fuel oil and raw materials for thousands of other products.

Light vs. Heavy

There are hundreds of different grades of crude oil that come out of the ground. Most commonly, the crude will be described as light or heavy and sweet or sour.

Examples include Light Louisiana Sweet (LLS), West Texas Intermediate (WTI), and Petrozuata Heavy.

Light crude oils produce a higher percentage of gasoline and diesel in the refining process. Additionally, since sulfur and other impurities must be removed from the crude oil prior to refining, sour crudes have a higher cost of processing.

Therefore, Light and Sweet crude oils sell at a premium in global markets to Heavy and Sour grades.

Production: The First Step in Adding Value

The first step in adding value to reserves is to produce the oil and gas from reservoirs to the surface. Oil and gas production is considered part of the upstream segment of the industry, as shown in the Adding Value chart.

Land wells can be drilled less than 100 feet (30 meters) deep and totally vertical, or 20,000 feet (6,000 meters) deep and horizontal. The surface facilities are installed when the well is proven to have commercial production.

Offshore wells can be drilled miles deep or miles in a horizontal direction. There are even highly complex “J” and “S” configurations with numerous branches, or laterals, emanating from the original, or “mother”, hole.

As shown in the Value for Production chart, offshore facilities often combine continuing drilling operations with production facilities located on the offshore platform above the surface of the water.

As mentioned earlier in this module, most oil and gas companies do not drill their own wells. It is outsourced to a number of large, sophisticated global oilfield service contractors.

Production Decline Curves

The inevitable fact of every oil or gas field is that production will eventually decline (refer to the Classic Erosion in Value for Production chart). Rates of decline can vary dramatically as can the point at which production from a well or a field is no longer cost effective.

During the early years of the oil and gas industry when fields and reserves were plentiful, producing companies tended to abandon a field to move on to the next “find” as soon as productivity declined and the field became troublesome.

With the maturation of the industry, new reserves have become elusive and more emphasis has been placed on producing reserves that were previously left behind.

Developing these “mature” reserves can be quite costly. The decision of whether or not to develop mature reserves is highly dependent on the price of oil and gas.

Shale Decline Curve Concern

There is an on-going debate as to whether the boom in domestic shale oil and gas production is a long-term event or a mere blip in the current trend of production decline.

This concern is based in some evidence that production decline curves for shale reserves are steeper than those for conventional reservoir wells.

This leaves some to wonder whether the current uptick in production is merely a temporary bubble.

Ultimate Recovery

Ultimate recovery is one of the greatest underlying themes for the future of the oil and gas industry. The goal is to leave as little valuable hydrocarbon resource behind as possible.

In developing an oil field, the ultimate ability to recover the hydrocarbons in a reservoir can range between 10% and 80% depending on:

- Reservoir quality and consistency

- Well and reservoir fluid properties

- Field production strategies

- Other geological factors including rock permeability, porosity, and water saturation.

As shown in the Technology to Extend Value chart above, economics drives the decision to keep producing from a particular field.

Primary recovery is defined as the ability to drive oil or gas to the surface with normal well operations and existing reservoir pressures. The average global primary recovery factor is 32%. In mature basins such as the North Sea or North America, two-thirds of the reserves were still in place at abandonment prior to the development of enhanced recovery techniques.

Secondary recovery techniques like water flooding may bring the recovery factor up to 40%. Here, huge quantities of water are injected into the edges of a producing field to drive the oil (lighter than water) to a collection point.

Tertiary recovery methods can use heat, steam, complex polymers, surfactants, and microbes to increase the recovery even further.

The Unconventional Future of Upstream

Unconventional resources are considered by the petroleum industry to be any resources extracted, or produced, by any method other than the traditional vertically drilled well. “Unconventional” refers to the method of extraction which is often much more complicated and expensive to perform than conventional drilling.

Some major oil and gas resources that require unconventional recovery techniques include heavy oils, tight oil and gas, shale oil and gas, and oil sands.

Technological breakthroughs in unconventional oil and gas production in the last 15 years have altered the North American energy landscape.

These developments have also opened vast new production opportunities around the globe, complicating global supply dynamics and political regimes, including the dominance of OPEC.

In fact, US oil and gas production is higher than any time in the last 20 years due to these developments in the Upstream segment of the oil and gas industry.

As shown in the BP Statistical Review of World Energy chart above, these developments have led to a decline in the Middle East’s percentage of the overall proved global reserves from almost 64% in 1992 to 48.4% in 2012 while both North and South America posted significant gains.

The main sources of technological breakthroughs have come in the fields of horizontal drilling, hydraulic fracturing, and subsea engineering (especially deep water production).

Offshore Drilling

Some of the largest oil and gas discoveries of the last decade have been found in deep water off the coasts of Africa and South America as well as the Gulf of Mexico.

These fields can lie 30,000 feet below the earth’s surface and under 7,000 feet of water or more. The technical challenges in recovering these resources are vast and volatile oil prices dictate the economic feasibility of development.

The 2009 BP Horizon disaster in the Gulf of Mexico highlighted the risks associated with drilling in deep water conditions. BP was drilling in the Macondo oil field under 5,000 feet of water when the Horizon rig caught fire. This resulted in an uncapped well on the sea floor which spilled oil for 87 days.

Summary

The upstream segment of the oil and gas business concentrates on exploration and production, and caries the highest risk and return of the three segments – upstream, midstream, and downstream.

Oilfield services and supply companies play a big part in the success of this segment, providing their expertise to the oil and gas companies.

Identification of potential reserves and the ultimate production of oil and gas from reservoirs are the most important drivers of Upstream activities.

Light sweet crude oils fetch a premium relative to heavy sour grades in the marketplace because of their high yield of gasoline and lower processing cost.

Unconventional resources are considered by the petroleum industry to be any resources extracted, or produced, by any method other than the traditional vertically drilled well – including directional drilling, horizontal drilling, hydraulic fracturing, and deep water drilling.

Technological breakthroughs in unconventional oil and gas production in the last 15 years has altered the global energy landscape.

Read more about the difference between Upstream and Downstream.

Related Resources

Energy Risk Management

Risk Management in Oil and Gas

Oil 101

Power 101

What is a Nuclear Power Reactor Operator

Watts, Kilowatts, Megawatts, Gigawatts

Jobs Data

Global Energy Talent Index (GETI)

US Energy & Employment and Jobs Report (USEER)

Career Path in Energy Articles

Is Oilfield Services/Equipment a Good Career Path

Is Oil and Gas Production a Good Career Path

Is Electric Utilities a Good Career Path

Is Power Generation a Good Career Path