Today (Aug 22, 2022), global financial markets were in a frenzy. European power prices spiked causing a ripple effect that saw equities and the Euro plummet.

US energy prices were mixed as natural gas joined the global party but crude oil dropped.

The point however, is that natural gas is becoming more of a global market as Europe decouples its energy sector from Russian supplies. This means that LNG assets are in demand.

The article below got me thinking.

Who owns the LNG tankers?

What is the supply problem here? It doesn’t take too much thinking to understand that the demand side of this equation has flipped way faster than anyone ever expected. And ships aren’t just something you get delivered next day by Amazon.

+Europe’s natural-gas crunch sparks global battle for tankers – WSJ

LNG Before Ukraine

But let’s back up just a little.

Supplies of LNG ships were already tight before Russia invaded Ukraine. Major importers in Asia, notably Japan and South Korea, were the reliable customers in the market before Europe crashed the party.

Now, these two regional powers are bidding against each other driving a surge in day rates for LNG vessels that have doubled from a year ago.

+LNG tanker charter rates hit record as demand soars – Reuters

Developing Countries Left Out

From grain to fertilizer, inflationary pressures in commodities have not been kind to developing nations, and the bidding war in LNG is no different.

As prices have gone up, some countries are just learning to do without. This includes lowering demand in the form of electricity blackouts.

“In some cases, cargo due to poorer nations have been diverted to Europe, experts say, in what can be a profitable trade even as suppliers are forced to pay penalties under contracts with developing nations.”

+Europe scoops up LNG, choking off power supplies in poorer nations – WSJ

Ouch.

LNG: Who Are the Suppliers

In order to supply LNG, you have to have (preferably cheap) NG. The three biggest LNG exporters at the moment are Australia, Qatar, and the US. The US has taken the lead as largest LNG exporter just this year.

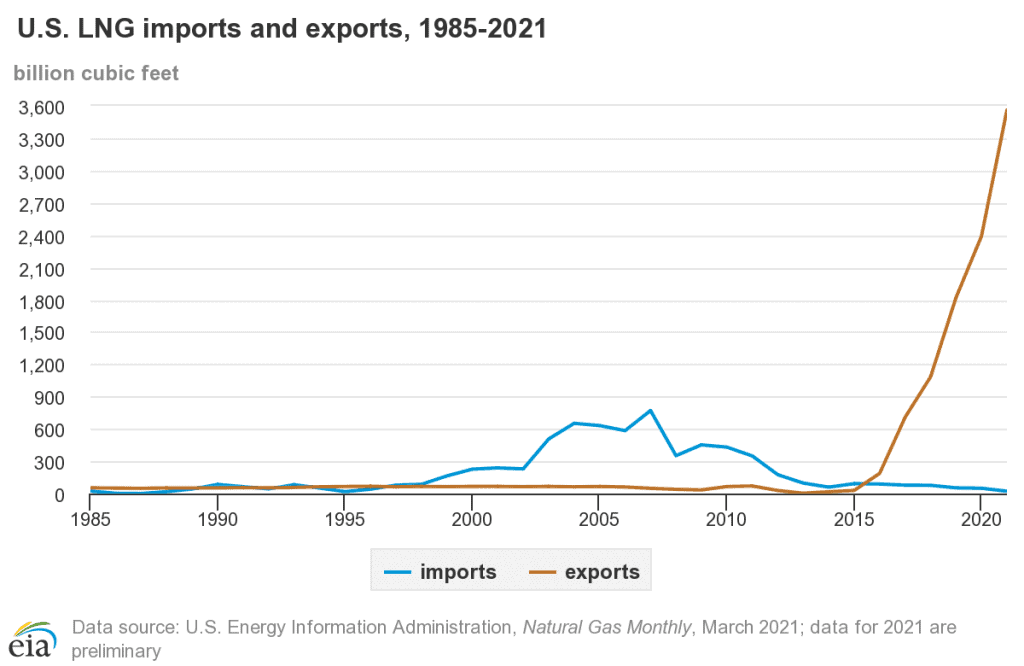

As this chart from the EIA shows, the US has rapidly become a huge player in this market.

+US became world’s largest LNG exporter in first half of 2022 – EIA

However, as this market grows, it is a race among exporters to expand capacity. So this neck-and-neck race means the lead is likely to shift among these three close contenders.

The Ships

Ok, so now. About those LNG tankers.

According to International Gas Union, there are 641 active LNG vessels as of April 2022. 57 of these were delivered in 2021, representing a 10% growth in the fleet.

+World LNG Report 2022 – IGU

Some large LNG vessel owners include:

- Nakilat (Qatar) – 69 LNG carriers – https://www.nakilat.com/our-fleet/

- Mitsui OSK Lines (Japan) – 45 vessels

- NYK Line (Japan) – 31 vessels

- Maran Gas Maritime (Greece) – 28 vessels

The Fleet is Growing

The impressive LNG fleet growth in 2021 looks set to continue in the near future as economics improve and customers become more willing to lock in long term contracts.

Samsung Heavy Industries, the South Korean shipbuilder, recently announced its largest single shipbuilding order – a $3 billion order for 14 LNG carriers. These ships won’t hit the market until 2024, but it goes to show the bullishness in this segment.

The order is believed to be linked to Qatar Energy.

+Samsung books its largest single shipbuilding order with LNG carriers – Maritime Executive

Learn More

Learn more about LNG in our Oil 101 course. This introduction to the oil and gas industry is a solid foundation in your energy education.

Oil 101 is used by companies around the world to get their new hires, sales teams, and more up to speed on the industry fast.