The dollar took a little pause from its recent rise as interest rate hikes come into question, relieving some pressure on dollar-denominated commodity prices and foreign markets.

Let’s take a look…

~Doug

What’s in this issue:

- Energy Market Recap

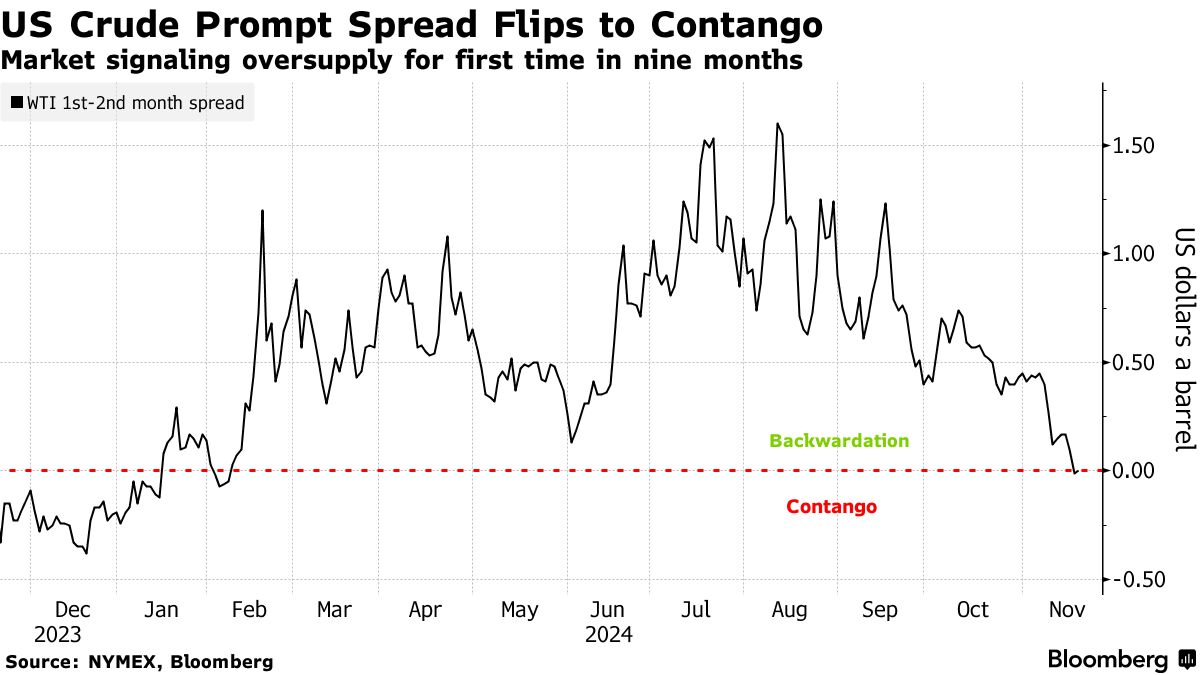

- Crude Goes Contango

- Headlines

| Crude Oil (Dec) | $69.16 | +2.14 | +3.19% |

| Natural Gas (Dec) | $2.973 | +0.150 | +5.31% |

| Copper (Dec) | $4.1200 | +0.0555 | +1.37% |

| S&P 500 | 5,893.62 | +23.00 | +0.39% |

| Energy Markets As Politico puts it: ”The decision is a major U.S. policy shift and comes as Biden is about to leave office and President-elect Donald Trump has pledged to limit American support for Ukraine and end the war as soon as possible.” There was also an onshore power outage that completely shut down production at Norway’s Johan Sverdrup oilfield. While the market is well supplied and the start of traditional heating season was pushed back a couple of weeks, low prices have curtailed production to some extent.Any prolonged cold weather could expose just how fast the supply overhang can be consumed. As Andy Huenefeld of Pinebrook Energy Advisors said in a note“lagging supply will become more apparent,” +Venture Global LNG’s second plant running over budget, document shows – Reuters |

| Oil 101 |

Crude Goes Contango  Bloomberg notes that the front spread in WTI has gone contango for the first time since February as the Dec contract dipped below Jan. Bloomberg notes that the front spread in WTI has gone contango for the first time since February as the Dec contract dipped below Jan.A contango market, while considered “normal” for physical commodities as the price difference should account for storage and interest costs, a steepening of this spread signals a short term oversupply in the market. We made this video on contango vs backwardation for our Oil 101 audience a while back if you’re interested. |

| Headlines “Leading oilmen haven’t suddenly become Greenpeace activists—strict regulations tend to work in their interest.” +Why Big Oil Doesn’t Mind Big Regulation – WSJ “Companies will pour almost $104bn into the space this year, according to estimates from Rystad, up by almost half since 2020 and the highest level since 2016. By 2027, that figure will rise to nearly $140bn.” +Offshore oil is back. At what cost? – FT ”The case had centred on allegations that Hin Leong had been hiding losses from trading in futures markets and selling off oil inventories already pledged as collateral for loans.” +Singapore oil trader sentenced to 17 years for ‘cheating’ HSBC over $112mn – FT “Google has also been using Chrome to direct users to its flagship AI product, Gemini, which has the potential to evolve from an answer-bot to an assistant that follows users around the web.” +DOJ Will Push Google to Sell Chrome to Break Search Monopoly – Bloomberg “The strong outlook for CCS demand growth gives us a high level of confidence in setting our new carbon storage growth target to build and operate a commercial carbon storage business,” +Santos Aims to Bury 14 Million Tons of Emissions a Year by 2040 – Bloomberg |

| Get Energized!Was this email forwarded to you? Click here to subscribe and get Energized delivered free to your inbox every weekday morning. |